Why Are Credit Cards

So Beneficial?

By

Zachary M. Potojecki

Have you

ever asked someone about credit cards, and they immediately tell you that they

are evil? If the answer is yes, then the odds are they never had anyone take

the time to explain how credit cards work and how they can be so beneficial to

you. Credit cards do have their pros and cons just as most things in life.

Let’s

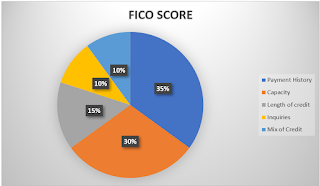

talk about your credit first. Are you the kind of person that has excellent pay

history, but your score is stuck in the low to mid 600's range? If this is you,

then odds are you may not have a credit card. Your credit report is made up of

two very large components. The first is “on time payments,” which makes up 35%

of your credit report, and an additional 30% is your “revolving credit.” Just

these two factors make up 65% of your credit report!

Revolving

credit is how much you can borrow on demand such as with a credit card. If you

have a thousand-dollar credit card limit, then you essentially have one

thousand dollars available to you wherever you go. Below, I have listed a

couple of bar graphs for you to better visualize what I am talking about.

Art

Anderson has a $1000 credit card limit but carries a balance of $900 on his

credit card. This means that he has only 10% capacity to borrow more money on

his credit card and is a red flag to the credit bureau because Art’s revolving

credit has been diminished and can actually hurt his credit.

Now, John Smith has a $1000 credit

card limit and carries a balance of $300. This means on his credit report he

has 70% capacity on his revolving credit, and that is a good sign to the credit

bureau. This can/will increase your credit score from being stuck in the 600's

to going into the 700 range. The reasons for this jump in his credit score are

the on-time payments and very low utilization of his credit card. The balances

on credit cards can be a gauge for a person’s ability to repay a loan. With

this being said, by John having more capacity on his credit card, then John is

more likely to repay his loans, so his credit score goes up. This example is an

excellent explanation of how a credit card can be so beneficial to your credit

score. (70% capacity is listed because John has $700 left on his credit card

after spending $300. $700/1000 = 70%).

The take-aways for the credit card is that with the right

usage and guidance, a credit card can be very beneficial to anyone trying to

improve their credit and give them the financial assistance they need on demand

wherever they have their wallet on them. Here at URW we have very competitive

credit card rates, especially when compared to some Capital One and Discover

cards that are in the mid 25% range, and other cards going as high as 36%. We

also do not have annual fees like many of the other credit card companies. If

you believe this post was beneficial, URW has a very quick and easy credit card

application that you can do from your smart phone, tablet, or computer, just

follow our link provided below and apply today!

Comments

Post a Comment