What Makes Up My Credit Score?

By

Zachary M. Potojecki

First,

there is a slight correction I must make to the title before we move forward.

Whether you rejoice or regret discovering this three-digit

number that defines your financial well-being, we often refer to it incorrectly.

It

should say, “What Makes Up My FICO?”

At URW, we use the Fair Isaac Corporation, or FICO for

short, which is the industry-standard for measuring creditworthiness of a

consumer, ranging from 300 to 850. The vast majority of lenders use FICO as

their standard for credit approvals. There are three different FICO versions,

which are TransUnion, Experian, and Equifax. At URW we use TransUnion.

You’ve probably seen a commercial for Credit Karma, Nerd

Wallet, and Quizzle. These apps are intriguing, as they offer free “credit”

checks at the touch of a button. While they do offer a good insight on what

your credit score may be based off of your financial history, they are

typically not as accurate compared to your FICO score. Also, they do not have the

same standards to rate your credit.

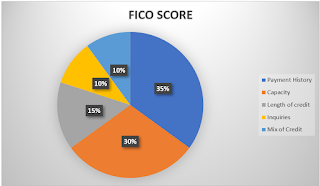

An individual’s FICO score is made up of 5 factors. The

first and largest factor is based on payment history. Payment history consists

of 35% of the credit score and it is more heavily weighted toward the most

recent pay history. This means that your pay history is going to be more

positively or negatively impacted by the last 12 months of pay history versus

pay history further out than that.

Approximate credit weight for each year:

·

40% = 0-12 months

·

30% = 13-24 months

·

20% = 25-36 months

·

10% = 37+ months

The next largest factor is the amount of capacity you have

available on lines of credit and credit cards. Capacity makes up 30% of your

FICO score. Our last blog broke down the details of how credit cards can help

your score improve. If you haven’t read it yet, click here to check it out.

The last three factors are much simpler, but together make

up the remaining 35% of your FICO score. One is the length of time you have had

credit. It takes time to gain credit, and this time is a 15% portion of the

credit report. Unfortunately, this is not exactly fair to young adults who have

not borrowed before and have zero credit. On the bright side, at URW, our

lending specialists will offer a share secured loan to help you build a

history. After roughly six months, we will offer a credit card to boost

capacity and to keep building history.

Following this is your accumulation of debt in the past

12-18 months, which is 10%. This is also includes your number of inquiries. Inquiries

are any time you apply for credit, whether it be a personal loan, mortgage,

auto loan, credit card, or a line-of-credit.

The last 10% is a mix of credit. This mix of credit is

between installment loans that raises your credit and revolving that lowers

your credit. Keep in mind, the revolving only lowers your credit if it is

excessive and you use a majority of your capacity on credit cards. Using

secondary finance companies also reduces your credit score as well.

I hope that this has been beneficial to you and has helped

you better understand what your FICO is actually made up of. Understanding how

your FICO score works is the first step to improving your overall score. For questions

and more detailed examples regarding your score, stop by one of our branches

and ask to see a lending specialist to break down your credit report with you.

Comments

Post a Comment