Your 2021 Personal Finance Checklist!

Your 2021 Personal Finance Checklist!

Welcome to 2021! The year 2020 was a struggle for most people due to the pandemic and many other uncertainties. We know that mastering personal finances can be tough even in the best circumstances, so with all that 2020 brought us, it was harder than ever. But fear not, as America and its people will prevail. We will learn from what we have been through. Here at URW we would like to help everyone learn and become better at managing their personal finances. We offer the proper tools and products to help you achieve the goals you desire. So let's start with the basics.

1. Review Your Spending and Automate Your Savings.

Okay, got it, but how?

URW has several tools with online banking to help you monitor and review your spending, as well as automate your savings. Go to our website: https://www.urwfcu.org/ -> Visit Netbrach -> login to your account -> click on My Money Snapshot. This allows you to view your past transactions, search for tags where you have spent money, and set a monthly budget for yourself. The budget feature is actually really cool. Let's say you set a monthly budget of $150 for dining out, $500 for groceries, etc. You can search for particular tags to see what you have spent the most money on. You can also set cash flow analysis to help map out your monthly deposits. In addition to those features, you can even create custom goals you can work towards, such as a down payment on a house.

If you have direct deposit with us, then you can come see a loan officer at your local branch, or even a teller, who can set your payroll to be automatically distributed to certain accounts. For example, let's say you get paid on a weekly schedule every Friday. Every time your direct deposit comes into your account we can set it for $25 a week to go into your savings account, $25 into your Christmas Club, $25 into your Vacation Club, and the rest into your checking account. I love this feature! I automate as much as possible personally. It takes a lot of emotion out of the picture and the forgetfulness, which I am very guilty of. This $25 a week turns into $1,300 in each of these accounts or $3,900 total savings for the year. Not bad right?

I'm going to elaborate a little bit more on this because I feel that is so important; PAY YOURSELF FIRST! Automation helps with this. If your company offers a 401K with an automated service where it takes out a portion for your retirement automatically, then do it. This way you make sure you pay yourself first. When you automate your direct deposit to savings, you're paying yourself first. Pay yourself first, pay bills, buy necessities, then what is leftover is yours for dining, drinks with friends, golf, or whatever activities you enjoy. Wouldn't you much rather say, "Yeah, I've paid myself already this month,' vs. "I wish I could have saved a little bit this month."

2. Top-Off Your Emergency Fund.

This goes hand-in-hand with what I just mentioned with automation. Add to your savings account, and create that little emergency fund. You never know when something crazy may arise such as a car repair, a loss of income, or any unexpected expense. Nobody wants to talk about it, but job loss and other unfortunate situations can arise. It is very comforting to know that you have a couple of months expenses in the bank account to help you through these tough times until you are able to find another source of income.

3. Pay Off Debt

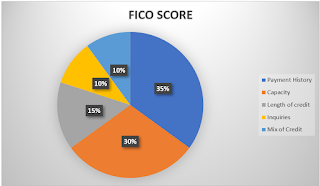

See what interest rates are the highest in your debt. Typically, credit cards have the highest interest rates. Pay these down, as well as student debt. The quicker you pay down these accounts, the more cash you have in your pocket at the end of month. Paying down credit card debt also has a positive impact on your credit score by increasing capacity. Check out my previous blog on credit cards to see how.

4. Review Your Insurance Policies

This might sound a little odd, and is something that a lot of people don't do that often. Check out your life insurance quotes versus different products people offer. Maybe what you have now isn't the best choice. Term insurance may be a better bargain in the long run instead of whole life insurance. We'll discuss the math in this in a later blog, but for now it may be worth looking into. Get some new quotes on your home and auto insurance as well. There are often better and cheaper rates out there. As always, do your due diligence. The more savings from these, the more cash you will have in your pocket.

In summary, following this small, easy checklist can help prepare you and your family for a much better financial well being not just for the next month, but for the rest of the year and years to come. Thanks for reading!

Comments

Post a Comment